By Deborah Jeanne Sergeant

Of course, you want your employees to feel satisfied with their health insurance benefits.

It’s a big part of their compensation package.

Routine care helps keep employees healthy and loyal to your company. But when their health insurance claims are denied, they can do something about it in many cases.

Now retired, George Chapman for many years operated G.W. Chapman Consulting as a hospital consultant. He advised that certain situations are no-brainer denials such as unpaid premiums, obtaining treatment outside the covered providers and — one that surprises many people — not following treatment protocols.

“For example, before surgery, the patient is required to go through physical therapy or lose weight,” Chapman said. “That’s a growing reason for denial: obesity. Anesthesiologists don’t want to put someone out who’s obese. That’s why they require weight loss, drug therapy or physical therapy before they get to surgery. I’ve had more people say, ‘I’ll be limping around a few more months until I go to the gym and lose weight.’ But people who are morbidly obese don’t do well with anesthesia.”

Another reason for denial is undergoing procedures or treatments that the insurer considers experimental, even if recommended or prior authorized by a provider. It doesn’t help to ask the provider if a treatment is covered or requires prior authorization.

“The doctor will say, ‘I have 20 plans to worry about; I don’t know who requires prior authorization,’” Chapman said.

Fortunately, fighting the denial based on prior authorization typically results in a win for the policyholder, according to Chapman. The same is true if the physician’s staff entered incorrect information that caused a denial. It pays to carefully review the information before sending it and any information the insurance company returns when they issue a denial. Patient information such as a wrong birth date, middle initial or code can send a claim into a tailspin.

“The final reason is that they consider it unnecessary,” Chapman said. “That’s where the provider has to jump in.”

A physician who stands up for patients can help get a claim moved along. Chapman said that the statue of limitations on claim denials is six months.

Chapman suspects that the number of claim denials issued by insurance companies has to do with the rising number of aging baby boomers.

“The companies’ profits will go down because they’re paying,” he said. “They make money on younger people who are healthy. They’re all finding that out. UnitedHealthcare typically has a lot of these Advantage plans that are ‘upcoding.’ They’re saying to the CMS, ‘Our patients are really sick. We need more money.’ They upcode to Medicare to get more money. When the member enrolls with their insurance plan, Medicare pays for each enrollee per plan.”

Fortunately for consumers, health insurance companies reverse up to 80% of claim denials. However, only 5% of people with a denial appeal it.

“It’s almost like a policy to deny and see who comes after us,” Chapman said of insurance companies. “Very few people challenge.”

He encourages people to gather their paperwork and work closely with their healthcare provider to make sure everything is filled out correctly and done according to the regulations of the health insurance plan.

“They want to make sure you have coverage so they get paid,” Chapman said.

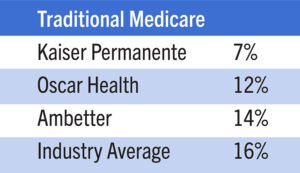

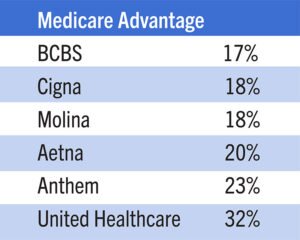

United Healthcare Leads List of Companies that Deny Claims the Most

When selecting your company’s health insurance plan, take a look at denial rates. They matter when employees need healthcare and contribute to the overall satisfaction with the plan. George Chapman operated G.W. Chapman Consulting as a hospital consultant. He shares claim denial rates among various insurers.